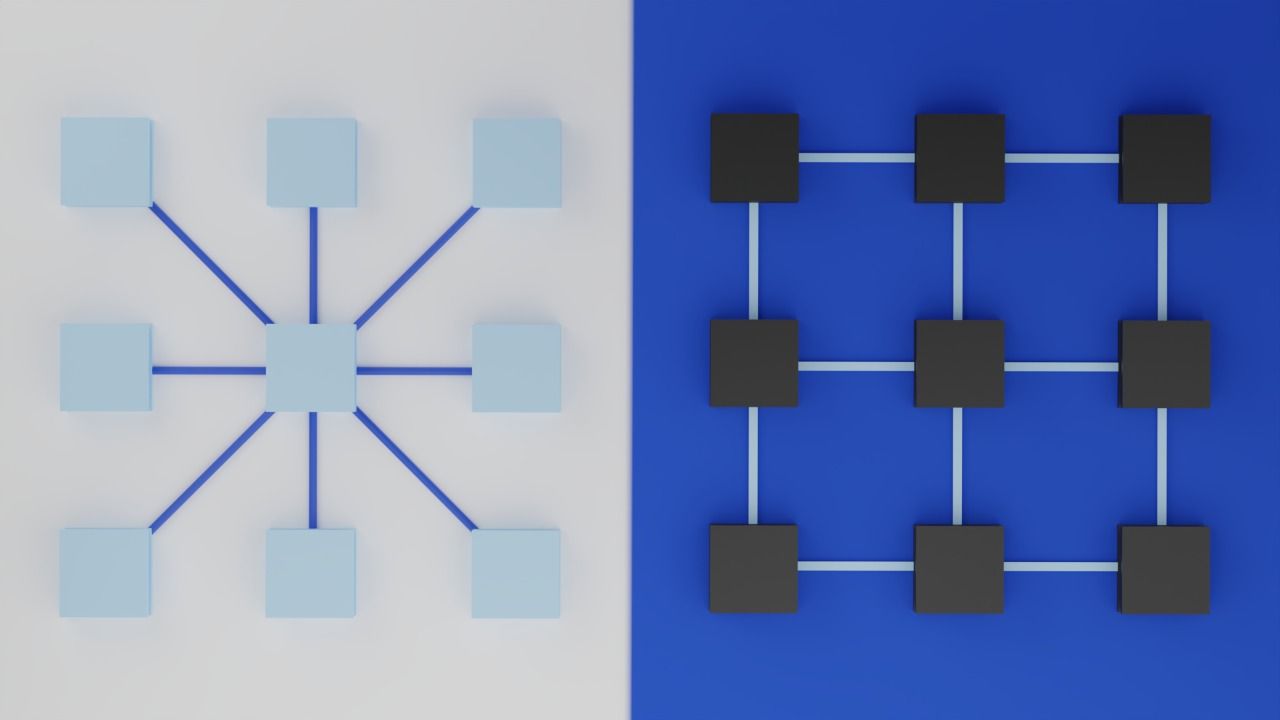

Centralised vs Decentralised Finance

The financial industry has evolved since its beginning, and a trend has been set into motion toward finding better ways of decentralisation to gain maximum transparency. Earlier, moderators or regulators, such as the banks, exchanges etc., helped to regularise and regulate the necessary finance in an economy.

The introduction of cryptocurrencies has accelerated this narrative. Even in the crypto economy, there are two types of finances: Centralised Finances or CeFi and Decentralised finance or DeFi.

Centralised Finance

Centralised finance has been the standard for trading cryptos since its inception in 2009, and it still has a strong hold over the crypto industry. In centralised finance, all crypto trades are handled through a single organisation. These are owned by one single entity or corporation; these teams then provide financial services for their consumers. This means the user has no ownership, and a third party is involved. For example, CeFi operates through CEXs or Centralised Exchanges. In a CEX, the exchange decides which coins they want to list for trading and the fees being charged. Every user registering must agree to the rules of buying and selling set by the exchange, including KYC.

Decentralised Finance

On the other hand, Decentralised Finance consists of financial services based on public blockchains that help a user trade, sell, lend, or earn interest without involving a third party. DeFi, therefore, is global and peer-to-peer and operates without going through a centralised system. In other words, it gives users the full ability and ownership of their funds. DeFi runs through DEXs and dApps. It creates a fair and transparent financial system without the requirement of a third party.

Ultimately, centralised and decentralised finance provides a wide range of financial services for those involved in the cryptocurrency ecosystem. So let's take a look at their advantages and disadvantages.

The Advantages Of CeFi

1. Fiat conversions: Conversion of fiat to cryptocurrencies requires a centralised authority. Since CeFi is based on this ideology, they offer better and more convenient ways and flexibility of converting fiat to crypto and vice versa.

2. Customer Support: Since centralised finance operates with the help of CEXs, they provide customer support and navigation to users making the experience easy to use.

3. Faster Transaction: The transactions are approved within the CEX, ensuring faster speed.

The Disadvantages Of CeFi

1. Higher Transaction Fees: Since many intermediaries or third parties are involved in transactions on centralised finance, there may be a higher fee.

2. Lack of Transparency: Organisations in CeFi lack complete transparency; they do not provide a public audit of their transactions and can't be verified.

3. Disclosure of personal information: Anyone operating on centralised finance has to fulfil KYC requirements which ask them to disclose their personal information fully.

4. No Ownership of Funds: In centralised finance, the funds are owned by the organisation or platform through which the user operates. This means that the user does not have complete access to their funds.

5. Hacking: The primary disadvantage is that centralised systems are always attractive to hackers. The users do not have access to their wallets, and their funds are stored with the CEX they use. As a result, they may lose all their funds if the exchange is hacked.

The Advantages Of DeFi

1. Services For All: DeFi has enabled anyone to access financial services. All you need is an internet connection, a mobile phone or a laptop to open your virtual Wallet and start trading. This eliminates the requirement for KYC, identity documents etc.

2. Users Retain Custody of their Funds: DeFi operates with the help of DEXs. The user can access these via their browser or phone and have a private key with which they can access, transfer, trade and loan their funds based on their discretion, i.e. they are in complete control of their funds.

3. Permissionless: Decentralised Finances are permissionless; in other words, a user has direct access to all services without any barrier or discrimination. It eliminates the presence of a third party as users do not require to complete any KYC process to access a service; they can directly do so by opening a defi wallet.

4. Transparency Of Transaction: Any transaction made on the network is verified by other users on the network. This ensures a level of transaction data transparency.

5. Banks the Unbanked: Many people worldwide cannot open a centralised finance account because they do not want to reveal their identity. With defi anyone can create a digital wallet to store the crypto assets and benefit from the financial services.

6. Lending & Borrowing - The decentralised finance has allowed lenders to receive payments and borrowers access capital without additional credit scores and interest.

7. No Mismanagement: Since the decentralised financial markets run on the concept of smart contracts, which run only when both parties fulfil the requirements, the possibility of mismanagement and error eliminates.

8. High Developmental Capacity: Most of the Blockchain used in a decentralised finance network are open service members; therefore, they allow other projects to benefit and operate on the chain, creating a sustainable ecosystem.

The Disadvantages of DeFi

1. Concerns of Liquidity: Since the liquidity in decentralised finances is controlled by user-funded transactions, it is unpredictable and challenging to maintain and hence causes major price issues for the token being traded.

2. User Responsibility: Since DeFi has taken away the intermediaries or the third parties, any human error Or loss that happens is upon the user.

3. Uncertainty: DeFi projects take off from host blockchains, whose inconsistency may transfer onto the projects creating difficulties for the user.

4. Congestion: Often, the blockchain becomes congested due to the requirement and the time taken to confirm a transaction, leading to higher transaction rates (gas fees!)

Conclusion

Both DeFi and CeFi work towards achieving the same goals: to provide access to a financial system in an ecosystem that helps people trade, lend, borrow and develop an economy.

In CeFi, the main objective includes security of funds and fair trade according to the terms set by the service provider; however, DeFi aims to facilitate financial activity to everyone without any barrier as to who can enter.

Both centralised finance and decentralised finance have their advantages and disadvantages. It mainly depends on the user and their priorities to decide what platform suits them the best. However, anyone looking for higher rewards and more transparency, security and control should look into opportunities in DeFi. Protocols like ZeroSwap have a range of services to offer with a multitude of products and services in the suite.

About ZeroSwap

ZeroSwap provides users a simplified way to swap on multichains with zero gas fees. We pay gas for users when they swap on-chain, using meta-transactions.

We are live on Binance Smart Chain, Polygon, Avalanche, and Fantom and plan to integrate Optimism, CELO, Aurora, and Ethereum Chain soon.

In addition, our product suite includes the Gasless ZeroSwapDEX, Staking, IDO platform ZeeDO and our native Bi-directional Bridge, and a B2B Service Based Product called DeFi Wizard.

Join Us!

Website | Announcement Channel Discord | Telegram | Twitter | Zeroswap Ecosystem | Reddit